I need help with my BAS!

Thanks for letting us know that your BAS isn’t quite ready and you need some assistance.

What seems to be the problem?

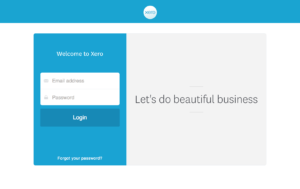

I forgot how to log in

Your log in details should be your email address.

If you have forgotten your password, you can reset it on the Xero login page.

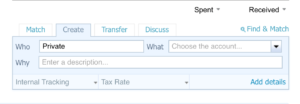

What do I do with personal expenses?

If you are reconciling your transactions, and come across a transaction that is not business related, follow these steps in the create tab.

Who: narrate the transaction Private.

What: your Xero file should have an account set up to allocate private transactions to. Common names for these accounts are things like Private/Personal/Drawings, Private Drawings or Owner Drawings.

If you start typing these in the Who tab, the relevant account should appear. Select this and press OK and you are done.

I need a refresher course

If you need a bit more of a refresher around Xero and what to do, please let us know and we will give you some further training.

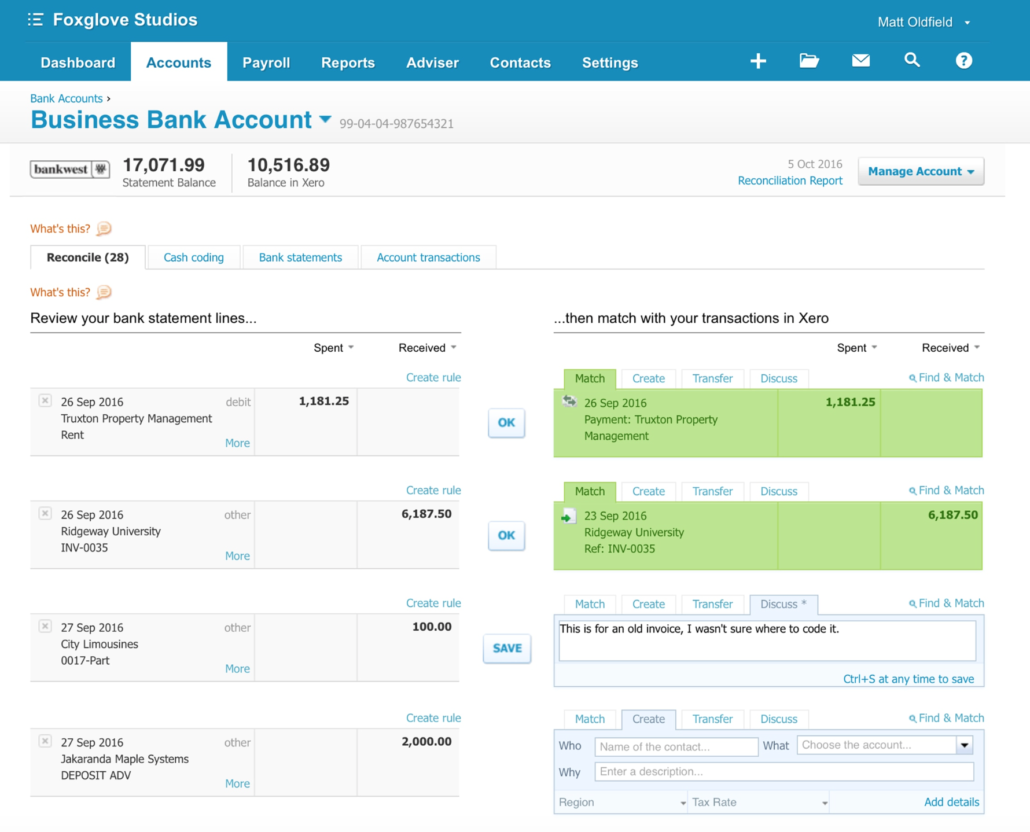

Where do I put a transaction?

The first step to allocating a transaction is to hit the blue reconcile button from your Xero dashboard. This will take you to all the transactions for a particular bank account that need allocating. For each transaction, use the amount and description to determine what the income/expense was.

Then in the WHO box, write a quick description of who the income/payment was from/to.

In the WHAT tab, you can either use the drop down arrow to scroll through a list of accounts. Most transactions will either fall under income or expenses, so focus on these and select the most relevant. Alternatively, you can start typing the account name is the WHAT tab (for example Bank Fees) and the account will appear to be selected. Once you have selected your account, the OK button will appear – click this and you have allocated your transaction.

If you are unable to find an account that appears to be suitable to allocate your transaction to, please click the DISCUSS tab and leave us a note detailing the nature of the amount. We can then allocate this amount for you to the correct account.

How do I add an account?

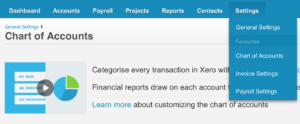

In most cases, the standard chart of accounts should be sufficient to allocate the majority of transactions. However, should you wish to add a new account – for example a new income account for a new income stream, click on the SETTINGS tab and select CHART OF ACCOUNTS.

From here, click the ADD ACCOUNT button. Account type – in most cases this will either be an Expense, Revenue or Sales account (for any other accounts, please contact Optimised Accounting. Other account types are a little more complex and may be best left to an Accountant). Select the relevant account type.

CODE: While this tab is not overly important, you are required to enter an account code that has not already been used. The best way to do this is prior to adding the account, have a quick look through the account codes already used and select something similar that is not taken. For example, if setting up an expense account, have a look at the existing expense accounts. If you see accounts 400 and 410 have been used, maybe set your new account up with the code 405.

TAX: Again, setting up the account code can be best left to your Accountant.

However, if your account is relatively straightforward – e.g. Sales A – and you collect GST on these sales, click on the drop down menu and select GST on Income. This will ensure all transactions entered to this account automatically calculate the GST collected. Alternatively, if you are setting up an expense where GST is paid – select the GST on expenses option. If the transaction does not have any GST – use the GST free income for GST free expense option.

Click the SAVE button and your account will be added and ready to use.

I have some expenses that aren’t showing up in my Xero

If you are reconciling your transaction and believe some transactions to be missing, you can double check this by clicking on the relevant bank account name from your Xero dashboard. This will show you all the bank transactions in a similar manner to a bank statement. Scroll or use the search function to look for the relevant date/dates of the transaction.

If you have missing transactions, there may have been a disruption to your bank feed which has resulted in some transactions not being downloaded from your bank feed.

In this instance, please email a copy of your bank statement/internet banking transactions to Optimised, with all missing transactions highlighted. We will manually enter these into your file and ensure that your account balances once again.

I used cash for something

You did what?

No problem, please add the item manually by following the below steps:

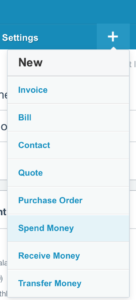

- From the Dashboard, click the plus icon

and select Spend Money.

and select Spend Money. - Select the bank account you’ve spent money from, then click Next.

- Enter your contact’s name. You can select an existing contact or add a new contact.

- Select the date you spent the money.

- Enter details of your transaction into the spend money transaction fields.

- (Optional) Click Assign expenses to a customer if you’ve spent money that you want to recover later as a billable expense.

- Click Save.

Please ensure you enter correctly if it includes GST or is GST free.

You’ll need to know the date paid, amount and nature of the expense.

How do I allocate my BAS payment?

Most accounts will have an ATO – Integrated Client Account set up.

Please allocate any payments made to the ATO to this account.

Other

Something else that’s not here? Get in touch with us and we’ll help you sort out what you specifically need.