https://www.optimisedaccounting.com.au/wp-content/uploads/2017/08/OA-website-logo.png

0

0

admin

https://www.optimisedaccounting.com.au/wp-content/uploads/2017/08/OA-website-logo.png

admin2024-05-15 12:40:032024-05-21 13:54:41Budget 2024 – Wrap Up Video

https://www.optimisedaccounting.com.au/wp-content/uploads/2017/08/OA-website-logo.png

0

0

admin

https://www.optimisedaccounting.com.au/wp-content/uploads/2017/08/OA-website-logo.png

admin2024-05-15 12:40:032024-05-21 13:54:41Budget 2024 – Wrap Up Video https://www.optimisedaccounting.com.au/wp-content/uploads/2024/05/ThumbBudget24-1.webp

1193

1207

admin

https://www.optimisedaccounting.com.au/wp-content/uploads/2017/08/OA-website-logo.png

admin2024-05-09 17:22:392024-05-20 12:54:22Budget 2024 live wrap-up and what to do before June 30!

https://www.optimisedaccounting.com.au/wp-content/uploads/2024/05/ThumbBudget24-1.webp

1193

1207

admin

https://www.optimisedaccounting.com.au/wp-content/uploads/2017/08/OA-website-logo.png

admin2024-05-09 17:22:392024-05-20 12:54:22Budget 2024 live wrap-up and what to do before June 30!

Your company isn’t a bank account: loan to a business right

You're finally your own boss, and in its early days, the business needs upstart funds. Such as a loan to a business, to sustain it until it finds its own feet. But you can't move funding sources in and out like in a bank account, and the ATO…

Can the ATO make a tax debt invisible to you?

For both individuals and small business owners, the idea of tax debt with unseen consequences is worrisome. It can impact future financial operations without clear signals or the usual pathways to address it.

Usually when you owe a tax debt,…

EV FBT exemption hitches: cautions for 2024

The clock ticks towards March 31st, the end of the Fringe Benefits Tax year. Employers are gearing up for “Check your Odometer Day” to report their car usage in the hopes of saving on their electric vehicle tax (EV FBT).

But under the…

Swerve out of car FBT record keeping roadblocks

31st of March every year marks the time to read the car odometer; not for the next visit to the mechanic, but for car FBT (Fringe Benefits Tax) reporting on your business' vehicles.

You’re providing a car and it’s your obligation to report…

Last minute Stage 3 Tax Cuts redesigned

Finally bringing down the knife: the Federal Government released a proposal to realign and redistribute personal income tax cuts legislation, to commence on 1 July 2024, for the 2025 financial return year.

[Edit 14th March 2024]: on the…

Can my SMSF invest in property development?

Australians love property. The lure of a 15% preferential tax rate on income during the accumulation phase, and potentially no tax during retirement, is enticing for SMSF trustees. It encourages them to pursue the dream of large returns…

Guilty as Charged: when your evidence doesn’t match what you tell the ATO

In the world of tax, good intentions only go so far. A recent case involving subdivided farmland before the Administrative Appeals Tribunal (AAT) reinforces that evidence must support the tax position you are taking.

The case involves…

House flipping tax incoming: a taxpayer claims a loss on her home

Flipping houses is a popular way, thanks to TV shows, for Australians looking for a profit renovating a property in order to sell it in the short term. But the reality is less glamorous: taxpayers may soon have to pay a house flipping tax…

A summary of all business tax changes this year

Employers & business

Superannuation guarantee increases to 11% from 10.5%

National and Award minimum wage increases take effect.

The minimum salary that must be paid to a sponsored employee - the Temporary Skilled Migration…

Why is my tax refund so small this year?

The tax refund many Australians expect has dramatically reduced. We show you why.

There is a psychology to tax refunds that successive Governments have been reticent to tamper with. As a nation, Australia relies heavily on personal and…

Small land subdivision makes for big tax costs

You’ve got a block of land that’s perfect for a subdivision. The details have all been worked out with Council, the builders, and the bank. But, one important aspect has been left out; the tax implications.

Many small-scale developers…

Rental Property Reporting Blitz

The Australian Taxation Office (ATO) has launched a full-on assault on rental property owners who incorrectly report income and expenses.

The ATO’s assessment, based on previous data matching programs, is that there is a tax gap of…

Tax obligations for online content creators

The explosion of OnlyFans, YouTubers, TikTokers and others all offer an opportunity for ‘content creators’ to profit from the audiences they generate. But now the Tax Office has given notice to the booming industry.

Back in October…

$3 million+ Super balance nest eggs will get their tax doubled

The Government has announced that from 2025‑26, the 15% concessional tax rate applied to future earnings for superannuation balances above $3 million will increase to 30%.

In a very quick turnaround from announcement to draft legislation,…

$20k Small Business Energy Incentive

In a pre-Budget announcement, the Government has committed to a Small Business Energy Incentive Scheme that offers a bonus tax deduction of up to $20,000.

The Small Business Energy Incentive encourages small and medium businesses with…

Instant Asset Write Offs (IAWO) capped to $20k again

From 1 July 2023 until 30 June 2024, the Government will change the instant asset write-off threshold to $20,000.

Previously, 'small' businesses under a turnover of $500 million, could immediately deduct assets acquired from 6 October 2020…

Slower asset write offs, some tweaks & changes to tax, and more money for ATO compliance!

Last year we had a double deal of government budgets, and without even coming full circle yet, it's time for this year's budget.

https://vimeo.com/825343630

Businesses have limitations and compliance warnings to be aware of,…

Why your tax return will be $1500 worse this year

For the past couple of years, you may have gotten used to your tax either costing less than you remember, or your refund being more generous. More money for you to spend on necessities, or an extra treat for the holidays.

But that won't…

ChatGPT versus accountant: Showdown

It feels like AI truly are taking everything over. So, without exercising too much paranoia, we wanted to test the mettle of this latest innovation to take the world by storm, ChatGPT. Will it work with the Australian tax system, making…

What Work from Home deductions apply for me?

The Australian Taxation Office (ATO) has updated its approach to how you claim expenses for working from home.

The ATO has ‘refreshed’ the way you can claim deductions for the costs you incur when you work from home. From 1 July 2022…

FBT in 2023

2024 update: since these electric vehicle concessions were released, the ATO's been catching out business reporting incorrectly and hybrid electric vehicles have different rules. Head to our 2024 article for all the details.

Fringe benefits…

Queensland backs down on Australia wide land tax

The Queensland Government has backed away from an amendment that would have seen the land tax rate for investment property in Queensland assessed on the value of the investor’s Australia wide land holdings from 1 July 2023, not just the…

To cut or not to cut? Stage three personal tax cuts

In September, amid a climate of startling interest rates, UK Chancellor Kwasi Kwarteng announced a series of tax cuts, including the reduction of the top personal income tax rate that applies to those earning more than £150,000 from 45%…

Can I claim my crypto losses?

The ATO has released updated information on claiming cryptocurrency losses and gains in your tax return.

The first point to understand is that gains and losses from crypto are only reported in your tax return when you dispose of it -…

Who can get the new electric car tax concession?

New legislation before Parliament, if enacted, will make zero or low emission vehicles FBT-free. We explore who can access the concession and how.

FBT free electric cars

Electric vehicles (EV) represent just under 2% of the new car market…

Do you pay taxes when selling a house that’s your home?

Everyone knows you don’t pay taxes when selling a house in which you live…right? We take a closer look at the main residence exemption that excludes your home from capital gains tax and the triggers that reduce or exclude that exemption.

What…

What is the ATO looking for this tax time?

With tax season almost upon us the Australian Taxation Office (ATO) has revealed its four areas of focus this tax season.

Record-keeping

Work-related expenses

Rental property income and deductions, and

Capital gains from crypto…

What is Audit Insurance?

As part of our products and services, we offer Audit Insurance to all of our clients (both business and individual).

We partner with Accountancy Insurance for this product as they seem to have the most well rounded and competitive policy.…

The 120% deduction for skills training and technology costs

It’s a great headline isn’t it? Spend $100 and get a $120 tax deduction. Days after the Federal Budget announcement that businesses will be able to claim a 120% deduction for expenditure on training and technology costs, we started receiving…

Can I claim a tax deduction for my gym membership?

There are lots of reasons to keep fit but very few of them have to do with how we earn our income. As a result, a tax deduction for a gym membership isn’t available to most people.

And yes, the Tax Office has heard all the arguments before...

'Keeping…

Selling an investment property?

When you sell an investment property, you may make either a capital gain or a capital loss.

A capital gain or loss is the difference between what it cost you to obtain and improve the property (the cost base) and the amount you receive when…

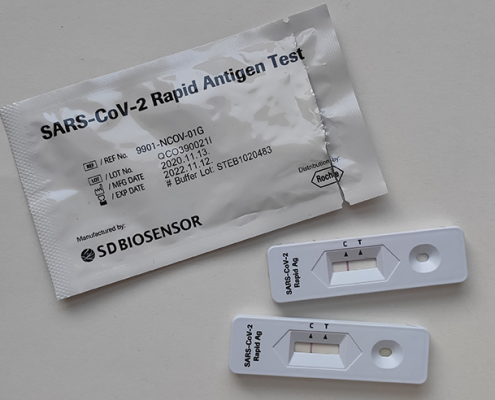

Are RAT tests tax deductible?

Are Rapid Antigen Tests (RAT) tax deductible? Well, a recent announcement from the government says yes.

Let's go through it all.

The government announced on 7 February 2022 that they will ensure COVID-19 testing expenses are tax…

Tax implications of cryptocurrency

With cryptocurrencies gaining notoriety, many people are unclear on how or when they can be taxed. Despite widespread belief to the contrary, you can be taxed on gains made as a result of obtaining or using cryptocurrency. If you’ve made a…

2021 Tax Preparations for Individuals

Tax time is here.

We have put together a list of Q&A's for how things will work this year, so you can get organised.

Covid is obviously throwing a spanner in to the works, but right now we are planning to do In-person appointments in our…

Am I taxed on an insurance payout?

Australia has had its fair share of disasters over the last few years – drought, bushfires and floods – that have ramped up the volume of insurance claims. Most people would assume that if and when they need to claim on their insurance,…

Work from home expenses under scrutiny

If you worked from home during lockdown and spent money on work related items that were not reimbursed by your business, you might be able to claim some of these expenses as a deduction – but not everything you purchase can be claimed.

The…

Reminder about your group certificate

As tax time for individuals comes closer, we’d like to remind you that most employers won’t be handing out what is commonly called a Group Certificate or also referred to as PAYG Payment summaries.

These are now known as Income statements…

Tax updates: March 2021

Individuals and small business owners who have taken advantage of the government’s COVID-19 support programs will find themselves increasingly under the tax man’s microscope in coming months. This is just one of the key developments occurring…

Tax From Your Couch details

After huge success from previous years, Tax from your couch is here to stay!

Tax from your couch

The process:

First, get in touch. Email us when you are ready to begin, (or if you have received an email to us, click the link when…

December tax updates

Although individuals and small business owners are now enjoying welcome tax relief in the wake of some valuable tax changes, there is more on the horizon as the government seeks to reboot the Australian economy.

Here’s a quick roundup of…

Tax-effective ways to boost your super

After a year when the average superannuation balance fell slightly or, at best, moved sideways, the summer holidays could be a good opportunity to think about ways to rebuild your savings while being mindful of tax.

With the Reserve Bank…

Tax deductions for investing in your business

Stimulating investment is high on the Government’s agenda.

To encourage spending, the 2020-21 Budget introduced a measure that allows businesses with turnover under $5bn* to immediately deduct the cost of new depreciable assets and the…

Understanding CGT when you inherit

Receiving an inheritance is always welcome, but people often forget the tax man will take a keen interest in their good fortune.

When ownership of an asset is transferred, it triggers a capital gain or loss with potential tax implications.…

Family trusts under ATO scrutiny

Family trusts have stood the test of time as a means of protecting family and business wealth, and managing the distribution of trust income in a tax-effective way. But the misuse of these tax benefits by a small minority periodically puts trusts…

What’s changing on 1st July 2020?

Company tax rate reduces to 26% for base rate entities

Cents per km rate for work-related car expenses increase to 72 cents

Expected reforms to allow 66 and 67 years olds to make voluntary superannuation contributions without…

Calculating your working from home deductions

With many people now working from home because of COVID-19, some of the expenses your employer normally pays – such as electricity, heating and cooling – are now coming out of your wallet.

Although some employers may provide a daily…

Guest post: Depreciation on investment properties

We have a guest post from our friends over at Capital Claims Tax Depreciation.

How claiming for depreciation boosts cash flow

Right now cash flow is front of mind for so many landlords. With the economy hurting, maximising cash flow from…

CGT and the family home: expats and foreigners excluded from tax exemption

Late last year, legislative changes were made that exclude non-residents from accessing the main residence exemption. The retrospective changes directly impact foreigners and expats whose main residence is in Australia or overseas. We explore…

ATO targets lifestyle assets

The ATO has requested insurance policy information from 30 insurers for lifestyle assets such as yachts, thoroughbred horses, and fine arts.

The review, expected to impact 350,000 taxpayers, reaches from the 2015-16 to 2019-20 financial…

Bushfire relief from the ATO

Ten million hectares, lives lost, wildlife on the brink, billions in lost revenue and clean-up costs. For many, returning life to normal is a long way off this summer.

Among all the generosity from Australians, celebrities and businesses,…

Your car log book: what you need to prepare

Using your car for work purposes? Here's what you need to record depending on the method used, including your car log book, what you can claim and for how long.

If you're an employer, read our FBT guide and how to ease the process of…

Tax concessions: helping small businesses

Running a business keeps you pretty busy, so it’s easy to overlook the help that’s available. Many small businesses don’t realise the government offers a range of valuable concessions that can make a real difference to their annual tax…

Christmas is coming – avoid being stung by FBT

Don’t want to pay tax on Christmas? Here are our top tips to avoid giving the Australian Tax Office a bonus this festive season.

Vacant land deduction changes

Legislation that passed through Parliament last month prevents taxpayers from claiming a deduction for expenses incurred for holding vacant land.

The amendments are not only retrospective but go beyond purely vacant land.

Previously,…

How the ATO is cracking down on bitcoin

After years of puzzling over how to deal with cryptocurrencies, the world’s governments – and their tax authorities – are finally getting serious about regulation. In an effort to crack down on tax evasion and other criminal activities,…

Positives and negatives of gearing

Negatively gearing an investment property is viewed by many Australians as a tax effective way to get ahead.

According to Treasury, more than 1.9 million people earned rental income in 2012-13 and of those about 1.3 million reported a…

Rental property expenses: what you can and can’t claim

It’s not uncommon for landlords to be confused about what they can and can’t claim for their rental properties.

In general, deductions can only be claimed if they were incurred in the period that you rented the property or during…

The small biz tax gap

Last month, the ATO released statistics showing small business is responsible for 12.5% ($11.1 billion) of the total estimated ‘tax gap’.

These new figures give visibility to tax compliance issues within the small business sector…