Posts

House flipping tax incoming: a taxpayer claims a loss on her home

Flipping houses is a popular way, thanks to TV shows, for Australians looking for a profit renovating a property in order to sell it in the short term. But the reality is less glamorous: taxpayers may soon have to pay a house flipping tax…

A summary of all business tax changes this year

Employers & business

Superannuation guarantee increases to 11% from 10.5%

National and Award minimum wage increases take effect.

The minimum salary that must be paid to a sponsored employee - the Temporary Skilled Migration…

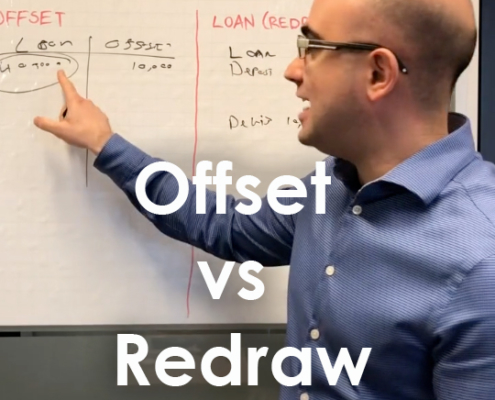

Offset vs Redraw

Shaun Farrugia recently created this video to explain a question that was on a few of our clients lips.

Watch below to hear the difference between an offset and a redraw account on your home loan. This is a question we do get very often,…

Are you flushing money down the drain by putting off refinancing?

Every year thousands of Aussie families flush their hard earned dollars down the gurgler because they put off the simple act of refinancing their mortgage. If you’re overdue, rest assured that it’s much easier than you may think!

While…

Putting the property price dip into perspective

Sure, the value of the average Australian home may have fallen for nine consecutive months, but it’s far from doom and gloom. Let’s put it all in a bit of perspective.

It’s easy to see a headline such as “Australian dwelling…

Don’t blow the budget on your next property purchase

You know how it goes. You see that dream property you’ve just got to have, and then next minute, the budget is in smithereens. Well, at least that’s what happens to almost a quarter of home buyers. Here’s how to keep a lid on your…

What you need to know before buying your second property

Whether it’s as an investment asset or a holiday home, buying your second property poses a unique set of challenges. Here’s what you should consider.

Australians love property, and it’s not difficult to see why. Property is seen…

Going guarantor on a family member’s loan?

Saying no to family is always difficult. But if a family member or friend asks you to become a loan guarantor, it always pays to think carefully before signing on the dotted line.

Being a co-borrower or guarantor on a loan certainly has…

Lending restrictions could soon ease

Financing options for homebuyers could open up once more with the federal government suggesting that lending restrictions could be eased if property prices fall sharper than expected.

Federal Treasurer Scott Morrison says the government…

Why it might be time to consider a principal-and-interest home loan

Australians have gravitated towards the benefits of interest-only home loans in high numbers in years gone by. But a raft of changes mean it might be a good time to start looking into the principal-and-interest option instead.

In Australia, four…

Regulator to crack down on home loan lending standards

It could soon become harder for Aussie families to secure a loan directly from lenders, with the prudential regulator warning people to prepare for a crackdown on lending standards.

APRA’s main concern is that banks and other lenders…