Posts

An update on the 120% deduction for skills training and technology costs

You may remember us posting about the 120% skills training and technology costs deduction in May as it was announced. (for a recap on that post, find it here).

The Government has reinvigorated the 120% skills training and technology costs…

Small Business Specialist Advice Pathways Program

We sent out an email about a new grant and we said that there were limited applications available. Well, it has been exhausted and they are now taking waitlists.

To quickly sum up:

The Victorian government announced a new $2000 grant for…

Construction support

On the 2nd October the Victoria Government announced they would support construction businesses with cash grants for the 2 week closure of the construction industry.

Applications are now open.

If you are a managed business client of ours,…

Covid Hardship Fund & more support

The Victorian Government have announced some additional assistance on 4th September.

This covers a 4 week period, which ends on 30th September 2021 as we drive towards our vaccination targets.

The majority of payments are automatic top-ups…

Digital Adaptation Program extended

The Victorian Government's Small Business Digital Adaptation Program program provides $1200 rebates so small businesses can access a range of digital business tools.

The Victorian Government has partnered with 14 suppliers to help you build…

More support for Vic businesses

The Victorian government have announced some new supports to help businesses most affected by the current restrictions.We're going to specifically talk about these support measures:

The Covid-19 Disaster Payment

An additional $2,800…

Business Costs Assistance Program Round 2

This evening the Victorian Government finally announced the eligibility criteria for the latest business grant. This is to help with the most recent lockdown in May–June 2021.

Eligible businesses with an annual payroll of up to $10 million…

Circuit breaker grant

The Victorian Government recently announced funding to certain businesses that were affected with the recent 5 day snap lockdown.

There are 4 initiatives to help a broad number of industries, but the one we'd like to bring to your…

How to sign up to Xero and get the Vic digital rebate

The newest Victorian rebate is to help small businesses get online, sell online, or do more online.

This includes things like getting a website, and also signing up to Xero which is great.

Xero have explained how to go about doing…

3rd round of Victorian grants

The Victorian Government has announced a third round of the Business Support Fund to provide direct financial support to businesses impacted by restrictions in Victoria. The amount of the grant is between $10,000 and $20,000 depending on the…

More support for Victorian Businesses

Over 2 days, the Victorian Government has announced two new support packages delivering over $3 billion in “cash grants, tax relief and cashflow support."

There are almost no details on the packages as yet – just the announcements. We…

Stage 4 lockdown – support for business

Additional business support has been announced to help eligible businesses with the latest restrictions.

Weren't previously eligible for JobKeeper?

Although you may not have qualified for JobKeeper originally, stage 4 lockdown may have…

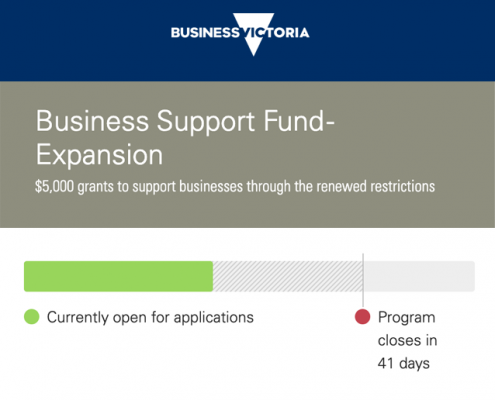

Business Support Fund Expansion

This article is an August 2020 update, for the latest BSFe information please head back to our blog page.

Businesses which have already received a $5,000 BSFe grant, or have applied for one, will not need to re-apply. Successful…

HomeBuilder: What is it and how do you access it?

The Government has announced grants of $25,000 to encourage people to build a new home or substantially renovate their existing home.

The HomeBuilder scheme targets the residential construction market by providing tax-free grants…