Posts

Optimised Accounting is moving office

On the 14th of August 2023, we're moving to 89 Simcock Avenue, Spotswood!

We are thrilled to announce that our new office is strategically situated 7km from the CBD (and 300m from the Spotswood rail station) to be convenient for all our…

Shaun talks about family trusts

Shaun Farrugia was invited back onto the podcast 'Financial Autonomy' recently, and the episode is now available to listen to.

Shaun and Paul Benson talked about family trusts for 40 minutes, and it's worth a listen!

They talked about…

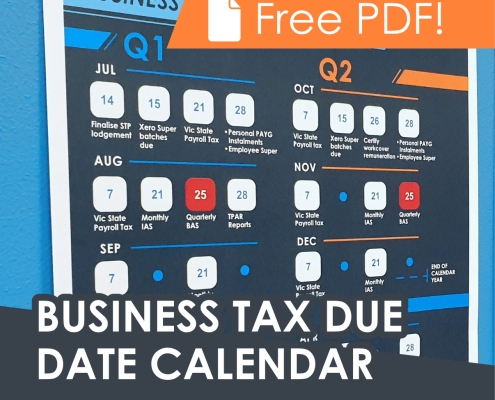

Keep up with your BAS due dates in 2023 with a Free Calendar!

Keeping up with all your business' BAS due dates gets complicated fast. PAYG, Payroll tax, BAS, superannuation... and dog's breakfast. Keep scrolling to untangle the chaos with our due date calendar, structured and clear so you know what to…

Investment Property Advice

Shaun recently was a guest speaker in an investment property live event with Wheatley Finance, called 'Good Debt, Bad Debt'.

The full recording (a whopping 2 hours of content) hasn't been released yet, but we will link to it when it becomes…

Business plan template

Happy New Year!

If you are excited about the new year and the possibilities that it brings, we have a gift for you.

A new year is a great time to sit back and reflect, and then improve your business.

Whether you are thinking about starting…

Business structuring webinar recording

Business structuring, while a dry topic, is important.

We recently held a webinar going through the ins and outs of the different business structures available in Australia, and the pros and cons for each.

Whether you are setting up a new…

Business Growth Checklist available

We have just created a new business download that is quite helpful.

Over at Optimised Accounting, we love checklist, and if you do too feel free to download this tool.

Once your business is up and running, it’s important not to rest…

2021 Tax Preparations for Individuals

Tax time is here.

We have put together a list of Q&A's for how things will work this year, so you can get organised.

Covid is obviously throwing a spanner in to the works, but right now we are planning to do In-person appointments in our…

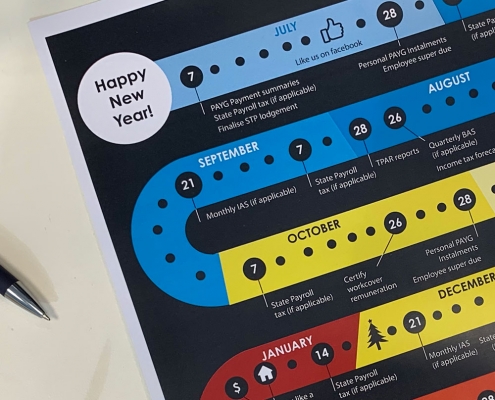

2021 Due dates

Business due dates available as download.

Updated posters available

The last 2 years Optimised Accounting created and distributed a poster for business owners to see at a glance the important due dates for businesses.

Now that all of…

Federal Budget 2021-22

The 2021-22 Federal Budget is a balancing act between a better than anticipated deficit ($106 bn), an impending election, and the need to invest in the long term.

Key initiatives include:

Extension of temporary full expensing and…

100% true blue

There is something that was on our radar for our business goals, and that was to be completely Xero focused. We find the Xero platform superior over others and find it far more beneficial to be highly skilled with the best rather than some…

2020 Budget wrap-up

This years budget is all about jobs

In what has been billed as one of the most important budgets since the Great Depression, and the first since the onset of the COVID-19 pandemic dragged Australia into its first recession in almost 30 years,…

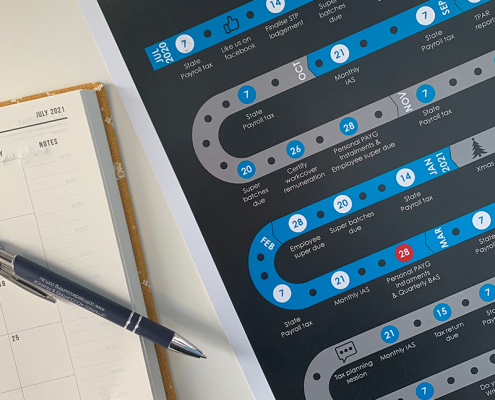

2020 Business due date calendar

On the back of the popularity of last years due date calendar, we have created a new one for this year.

We usually hand out these posters during pre-EOFY tax planning sessions, however this year these were done on Zoom.

If you would like to get your hands on one of these posters, please let us know.

coronavirus-stimulus-package-explained

CORONAVIRUS STIMULUS PACKAGE: A VIDEO FROM SHAUN

Shaun Farrugia has put together a video to explain the Government’s proposed Coronavirus Stimulus Package for business owners.

Today I’m going to give you some information…

Sponsoring a charity bike ride

We are excited to share that we are a major sponsor for a charity bike ride coming up in October.

Some of our long time clients will be participating in this ride, and we are happy to support them!

The bike ride will go towards MND…

Important due dates

We have recently created a poster for our business clients to remember some very important Australian business due dates.

We created this for our business clients, but they have been so well received that we've decided all business owners…

Tax from your couch 2019

Life is busy – we not only get it, but this year we are actually embracing it by making a way to do your tax without actually coming in.

This year we have introduced a new way of doing tax. From your couch. Yep you heard that right.

It's…

Business books: what are we reading right now?

Shaun has an entrepreneur mindset that is always seeking out information. Always looking for something better, self improvement, business improvement: more success all round. He encourages his team and clients to do the same, and we thought…

2019 Budget wrap-up

How will the 2019 Federal Budget effect me and my business?

Treasurer Josh Frydenberg's main talking point was that this budget will bring us back to surplus.

Back in black, back on track.

Here are the most important bits:

Small/medium…

What are PAYG Instalments?

PAYG Instalments, something that alot of our clients get confused about.

Pay as you go instalments (PAYG) get issued by the ATO, and you get sent a welcome or adjusted letter.

But do you understand it? Shaun Farrugia explains all you need…

Business structuring: which one is right for me?

Wondering how your business should be structured? In this article we are going to focus on the four main business structures: sole traders, partnerships, companies, and trusts. Get it right from the start and your business will be set up for…

The essential things you need to do to move to self employment – a podcast

Shaun recently sat down with Paul Benson to talk about making the move to self employment.

Have a business idea, think you can do things better than your boss, or ready to take your side-hustle to the next level?

Have a listen to this…

Changes to Long Service Leave from 1 November 2018

From 1 November 2018 the new Long Service Leave legislation will come in to effect in Victoria.

The fundamental that Long Service Leave starts accruing after 7 years of continuous service still remains, however much more flexibility has…

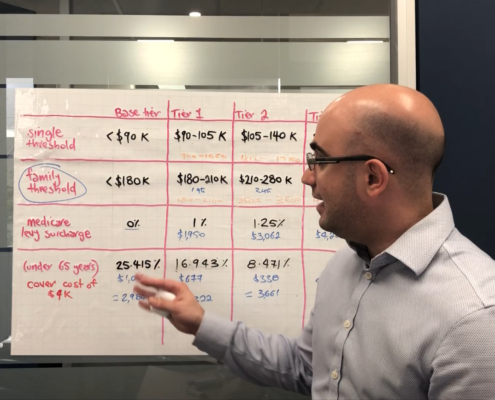

Do I need Private Health Insurance?

This is a question that we get a lot – particularly around June when the insurance companies have lots of ads on TV telling everyone that they will be severely penalised if they don't!

But do you really need it?

No, not necessarily for…

Offset vs Redraw

Shaun Farrugia recently created this video to explain a question that was on a few of our clients lips.

Watch below to hear the difference between an offset and a redraw account on your home loan. This is a question we do get very often,…

Budget wrap-up 2018

Tuesday night Scott Morrisson handed down what can be best described as an pre-election Budget and in our opinion a very tax centric budget.

No major announcements of increases or decreases in service spend and It is still expected that…

Shaun talks about Trusts: Podcast

Shaun Farrugia (Optimised's founder), recently sat down with Paul Benson from Financial Autonomy (who is also our trusted Financial Planner).

They talked about all things Trusts, including:

The dummies guide to what exactly a Trust is

…

Individual Tax Deductions Checklist

Can you believe it's tax time again already?

As we aren't holding in person tax return appointments this year, all information will be collected using our Tax From Your Couch.

If you'd like to gather your information in a spreadsheet prior…

2017 Budget wrap-up

We have put together a summary of the key tax and financial changes that were announced in last night’s federal budget.

This was Scott Morrison's 2nd budget and is focused on increased transport infrastructure spending which will support…

Your 2 minute guide to the tax and super changes that affect you and your business.

Below is a summary of the key tax and superannuation changes that were announced in this years federal budget.

There are some wins for business – aimed to stimulate ‘Jobs & Growth’ which was this year's slogan.

There are plenty…