Business and Tax articles

If you have anything specific you would like us to write about, please let us know.

Categories:

Business

Business

Tax

Tax

Due dates

Due dates

Covid-19

Covid-19

Business exiting

Business exiting

New business

New business

News

News

Superannuation

Superannuation

Personal Finance & Crypto

Planning & growth

Planning and Growth

Business structuring

Business structuring

Lifestyle

Lifestyle

New clients

New clients

Technology & Xero

Technology & Xero

Optimised news

Optimised news

Our latest articles:

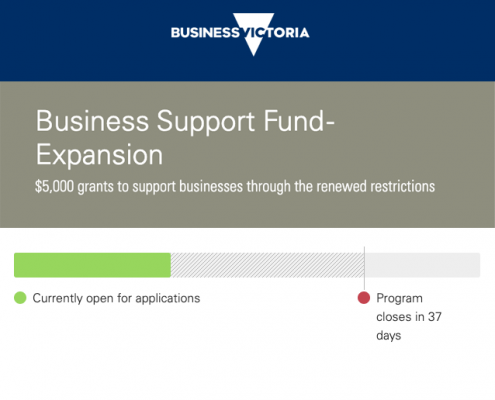

Victorian Business Support Fund

The Victorian Government has announced that Stage 3 ‘Stay at Home’ will be in reinstated across metropolitan Melbourne and Mitchell Shire from 11:59 on 8 July 2020 to help slow the spread of coronavirus (COVID-19) in Victoria. These restrictions…

ATO targeting Covid-19 fraud

We always knew that a Government scheme swiftly distributing cash during a crisis was going to come with equally swift compliance and review measures, particularly when eligibility was self-assessed. Two major Australian Taxation Office…

Leadership through challenging times

As all leaders can attest to, no leadership role is smooth sailing. There will inevitably be the occasional storm coming over the horizon, with different challenges you need to respond to.

Sometimes these challenges will be unprecedented,…

What happens if you don’t pay your super on time?

In the past, monitoring of superannuation payments was not as stringent as it is now. If employees did not regularly read their super statements or check their balances, it is entirely possible that super could go unpaid - and unnoticed by the…

Increased flexibility for Parental Leave for self employed

From 1 July 2020, parents accessing the Government’s parental leave pay (PPL) scheme will have greater flexibility and options.

Targeting the self-employed and small business owners, the changes introduce a new flexible paid parental…

2020 Business due date calendar

On the back of the popularity of last years due date calendar, we have created a new one for this year.

We usually hand out these posters during pre-EOFY tax planning sessions, however this year these were done on Zoom.

If you would like to get your hands on one of these posters, please let us know.

Family trusts under ATO scrutiny

Family trusts have stood the test of time as a means of protecting family and business wealth, and managing the distribution of trust income in a tax-effective way. But the misuse of these tax benefits by a small minority periodically puts trusts…

HomeBuilder: What is it and how do you access it?

The Government has announced grants of $25,000 to encourage people to build a new home or substantially renovate their existing home.

The HomeBuilder scheme targets the residential construction market by providing tax-free grants…

What’s changing on 1st July 2020?

Company tax rate reduces to 26% for base rate entities

Cents per km rate for work-related car expenses increase to 72 cents

Expected reforms to allow 66 and 67 years olds to make voluntary superannuation contributions without…

Could your business do with a cashflow boost?

The two cash flow boosts provided by the federal government to help businesses deal with the COVID-19 emergency have largely been overshadowed by the JobKeeper program, but they could provide valuable financial support to organisations that…

The ATO’s JobKeeper audit targets

“…while it is all very well to talk of 'turning points', one can surely only recognise such moments in retrospect.”

Kazuo Ishiguro, The Remains of the Day

The JobKeeper subsidy has progressed beyond the rush for eligibility and entered…

Calculating your working from home deductions

With many people now working from home because of COVID-19, some of the expenses your employer normally pays – such as electricity, heating and cooling – are now coming out of your wallet.

Although some employers may provide a daily…

JobKeeper is open!

JobKeeper registrations are now open.

We have created an updated video which explains all the changes that have come through in the last few weeks since the JobKeeper payment was announced. This can be found below.

Our fee details…

Guest post: Depreciation on investment properties

We have a guest post from our friends over at Capital Claims Tax Depreciation.

How claiming for depreciation boosts cash flow

Right now cash flow is front of mind for so many landlords. With the economy hurting, maximising cash flow from…

Instant Asset Write Off explained

*UPDATE* (November 2020)

A new article goes over the updates to Instant Asset Write-Off over here.

*UPDATE* (June 2020)

$150K Instant Asset Write-Off has been extended until 30th December 2020.

Read Josh Frydenberg's media release…

5 tips for working remotely (productively)

In the current climate, many businesses are needing to make changes to accommodate staff working remotely. If you are able to work from home the ensuing changes to your work habits can be challenging to negotiate, however there are things you…

Covid-19 FAQ’s

We’ve had alot of questions about assistance for businesses affected by Covid-19, so we are starting to compile them.

2nd Stimulus Package

23/03/2020

2nd Coronavirus Stimulus Package

The Government yesterday released a second, far reaching $66.1 bn stimulus package that boosts income support payments, introduces targeted changes to the superannuation rules, provides cash flow…

Covid-19 assistance

A constantly updated blog article with Covid-19 assistance measures and support for businesses.

coronavirus-stimulus-package-explained

CORONAVIRUS STIMULUS PACKAGE: A VIDEO FROM SHAUN

Shaun Farrugia has put together a video to explain the Government’s proposed Coronavirus Stimulus Package for business owners.

Today I’m going to give you some information…

The Stimulus Package: What you need to know

12/03/2020

The Government has announced a $17.6 billion investment package to support the economy as we brace for the impact of the coronavirus.

The yet to be legislated four part package focuses on business investment, sustaining employers…

How to get your payroll right

A series of high-profile examples of businesses underpaying their employees has brought the need to get payroll right into sharp focus.

Complex award and enterprise agreements can complicate payroll obligations, in terms of both regular salary…

FBT hot spots

With the start of the Fringe Benefits Tax year looming on 1 April, businesses are being urged to review their Fringe Benefits Tax (FBT) position.

The ATO’s top FBT problem areas

Motor vehicle fringe benefits

Failing to report motor…

Surviving a crisis: Coronavirus and beyond

10/03/2020

Empty restaurants and retail stores were one of the first signs of the devastating impact the coronavirus on Australian businesses.

Within a few months, the virus, now called COVID-19, has gone from being a largely unknown…

Could you live without your mobile?

We love technology, but do you feel like you’re trapped to the constant pinging of your phone, busier than ever?

You’re not alone, with the trap of always being ‘on’ a curse of the modern day world.

A 2019 report from BankMyCell…

Tradies: how does your insurance measure up?

As a tradie, you are largely dependent on your physical ability to earn a living. So, what would happen if you fell ill or had an accident? Would you be able to continue your current lifestyle?

Most tradies work in a far more dangerous…

The ins and outs of SMSF property investing

With a property market recovery underway, most notably in Sydney and Melbourne, Australian investors are once again pursuing their love affair with property investing.

For many investors, a popular way to invest directly in residential…

CGT and the family home: expats and foreigners excluded from tax exemption

Late last year, legislative changes were made that exclude non-residents from accessing the main residence exemption. The retrospective changes directly impact foreigners and expats whose main residence is in Australia or overseas. We explore…

ATO targets lifestyle assets

The ATO has requested insurance policy information from 30 insurers for lifestyle assets such as yachts, thoroughbred horses, and fine arts.

The review, expected to impact 350,000 taxpayers, reaches from the 2015-16 to 2019-20 financial…

Bushfire relief from the ATO

Ten million hectares, lives lost, wildlife on the brink, billions in lost revenue and clean-up costs. For many, returning life to normal is a long way off this summer.

Among all the generosity from Australians, celebrities and businesses,…

Getting your balance back

Early in the year makes for the perfect time to dust yourself off and recommit to your version of a balanced, healthy life.

Consider all aspects of your life

Before rushing ahead to create new goals and habits, take some time to consider…

Your car log book: what you need to prepare

Using your car for work purposes? Here's what you need to record depending on the method used, including your car log book, what you can claim and for how long.

If you're an employer, read our FBT guide and how to ease the process of…

Tax concessions: helping small businesses

Running a business keeps you pretty busy, so it’s easy to overlook the help that’s available. Many small businesses don’t realise the government offers a range of valuable concessions that can make a real difference to their annual tax…

Recognising your greatest asset – you!

Want to make 2020 your year? The year you reach great heights?

Key to reaching those dizzying heights is recognising that you are one of your greatest assets.

Being self-aware and knowing your worth is crucial to positioning yourself…

Taking philanthropy to the next level

Australians are generous when it comes to opening their wallet for a good cause. But you may have reached a point in life where you want to make a more substantial contribution with control over how your money is spent. You may also wish to…

The power of a mentor

Over the course of a lifetime we have people around us who support and guide us. Initially it’s our parents, then as we get older it extends to teachers and coaches. Even when we enter the workforce it can still be helpful to have the…

Optimising your Xmas break

Whether you’re glued to your desk most days or have honed the work/life balance, we all need to take a break at some point. The end of the year is a great time to reflect on your achievements and recharge. But while December is when…

5 things that will make or break your business this Christmas

The countdown to Christmas is now on and we’re in the midst of the headlong rush to get everything done and capitalise on any remaining opportunities before the Christmas lull.

Busy period or not, Christmas causes a period of dislocation…

Recognising the signs of potential insolvency

Australia’s economy is growing at a slower pace than many would like, with small businesses in some sectors doing it tough. Recognising the warning signs of potential insolvency is key to trading through difficult times.

Basically,…

Safe harbour for directors of struggling companies

Australia’s insolvent trading laws impose harsh penalties on directors of companies that trade where there are reasonable grounds to suspect that the company is insolvent.

Criminal and civil penalties can apply personally including…

5 key SMSF rules

The lure of greater control over your retirement savings with a self-managed super fund may be enticing but the freedom to chart your own destiny also comes with the responsibility to comply with the rules.

An SMSF is a private super…

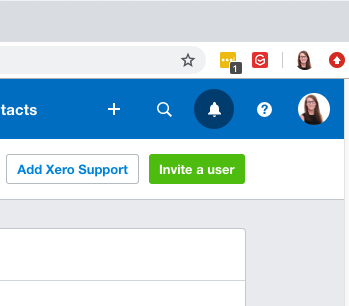

Adding a user into your Xero file

With all new clients we ask to add us as a user into your Xero file.

To help navigate this process we've created some screenshots to help explain how to do this:

1. Click on your Organisation name in the top left hand side of…

Christmas is coming – avoid being stung by FBT

Don’t want to pay tax on Christmas? Here are our top tips to avoid giving the Australian Tax Office a bonus this festive season.

Employee or contractor: what’s the difference?

With the rise of the gig economy, correctly working out whether you are hiring an employee or simply engaging an independent contractor has never been more important. Getting it wrong can be costly, as a recent court ruling shows.

A Perth…

Vacant land deduction changes

Legislation that passed through Parliament last month prevents taxpayers from claiming a deduction for expenses incurred for holding vacant land.

The amendments are not only retrospective but go beyond purely vacant land.

Previously,…

Calculating Super Guarantee: The new rules

From 1 July 2020, new rules will come into effect to ensure that an employee’s salary sacrifice contributions cannot be used to reduce the amount of superannuation guarantee (SG) paid by the employer.

Under current rules, some employers…

How the ATO is cracking down on bitcoin

After years of puzzling over how to deal with cryptocurrencies, the world’s governments – and their tax authorities – are finally getting serious about regulation. In an effort to crack down on tax evasion and other criminal activities,…

Data security: protecting your business

The recent Facebook scandal demonstrates how serious data security breaches can be, but they aren’t limited to large organisations. Is your business data secure?

Simply sending a file to the wrong person or leaving your phone in a taxi…

Productivity: Stop being so busy.

A smartphone buzzes in your pocket. Ten tabs sit stagnant in your browser. Unopened emails, newsfeeds and gifs all claw for your attention. This is the plague of distraction. And in our efforts to always be ‘on’ our actual productivity…

Xero expenses

If you have a Xero account for your business and you have staff that are constantly purchasing business related things without a company credit card, the app Xero Expenses is fantastic.

Instead of asking staff to keep their receipts, giving…

Selling a business? Don’t forget about tax

It can take many years and a lot of hard work to build a successful small business. When you finally decide it’s time to sell, tax is often the last thing on your mind. Yet it can have a big impact on how much of the sale price you get to…

Positives and negatives of gearing

Negatively gearing an investment property is viewed by many Australians as a tax effective way to get ahead.

According to Treasury, more than 1.9 million people earned rental income in 2012-13 and of those about 1.3 million reported a…

Super Guarantee Amnesty Resurrected

The Government has resurrected the Superannuation Guarantee (SG) amnesty giving employers that have fallen behind with their SG obligations the ability to “self-correct.” This time however, the incentive of the amnesty is strengthened by…

5 signs of a well run business

Every small business owner wants their business to thrive, but it can be tough to keep the money coming in the door while staying on top of all the necessary paperwork.

One way to ensure success is to understand the behaviours that separate…

Spring clean your business

This time of year we all tend to do some spring cleaning, and not just at home. Now that we are in the new financial year, you may have some numbers on how things are going and can clear out some unnecessary expenses.

The secret to a…

Cashless society

Australia is hurtling towards being a cashless society at a startling rate, with some pointing out that if the current trend were to continue it could be as soon as 2022.i

Though most would agree it’s unlikely that cash will be completely…

Rental property expenses: what you can and can’t claim

It’s not uncommon for landlords to be confused about what they can and can’t claim for their rental properties.

In general, deductions can only be claimed if they were incurred in the period that you rented the property or during…

SMSF trustees being contacted by ATO

The investment strategies of Self Managed Superannuation Funds (SMSFs) are under scrutiny with the Australian Taxation Office (ATO) contacting 17,700 trustees about a lack of asset diversity.

The ATO is concerned that, “a lack of diversification…

The small biz tax gap

Last month, the ATO released statistics showing small business is responsible for 12.5% ($11.1 billion) of the total estimated ‘tax gap’.

These new figures give visibility to tax compliance issues within the small business sector…

ATO take ‘gloves off’ on overseas income

Five years ago, the Australian Taxation Office (ATO) offered a penalty amnesty on undisclosed foreign income. Five years on, the ATO has again flagged that underreporting of foreign income is an issue but this time the gloves are off.

How…