Posts

A summary of all business tax changes this year

Employers & business

Superannuation guarantee increases to 11% from 10.5%

National and Award minimum wage increases take effect.

The minimum salary that must be paid to a sponsored employee - the Temporary Skilled Migration…

Inflation deflating your small business: 7 adjustment tips

Inflation is a term that we've all heard quite frequently lately, with rates rapidly increasing. Small businesses are particularly feeling the effects of inflation, with supplies costing more, employee shortages, and shrinking profits. In…

What do I do before EOFY?

EOFY is once again around the corner, and we encourage business owners to be proactive. Talk to your accountant, look at your books, and make any little adjustments needed before June 30 hits. This will have optimal results for next financial…

Instant Asset Write Offs (IAWO) capped to $20k again

From 1 July 2023 until 30 June 2024, the Government will change the instant asset write-off threshold to $20,000.

Previously, 'small' businesses under a turnover of $500 million, could immediately deduct assets acquired from 6 October 2020…

What Work from Home deductions apply for me?

The Australian Taxation Office (ATO) has updated its approach to how you claim expenses for working from home.

The ATO has ‘refreshed’ the way you can claim deductions for the costs you incur when you work from home. From 1 July 2022…

Making business moves with financial goals

Businesses tend to progress more consistently if the owner sets financial goals and makes a plan to achieve them. The new year is a natural time to decide what you want to achieve and how. With that in mind, read on to learn the steps for…

Essential business de-cluttering for the new year

The end of the year tends to be a bit chaotic for business owners, but it's actually a good time to get some extra housekeeping done for your business. Read on for some tips to help you finish the year neatly and feel prepared to face the…

Errors to avoid when setting up Payroll

Upgrading or changing your payroll system comes with a ton of wonderful benefits. Saving time and money, making everyone’s lives easier, and better integration are all good reasons to consider a change. But if the switch is mishandled,…

What are the differences between wages, salary, commission, and bonuses?

There are a few different methods that employers use to pay their employees, and while they may have similarities, they each also have their own implications for your business and its employees. On top of that, there may be a blended model…

Small Business Specialist Advice Pathways Program

We sent out an email about a new grant and we said that there were limited applications available. Well, it has been exhausted and they are now taking waitlists.

To quickly sum up:

The Victorian government announced a new $2000 grant for…

Do I need a .au domain name?

You may have already heard about the new domain extension about to launch in Australia, but don't dismiss this news as unimportant.

If you are a business owner, (especially if you have a .com.au domain name) this impacts you.

Failure to…

Should I keep my business in the family, or sell?

Planning for the succession of a business is an important and sometimes overlooked part of a business plan.

Once you exit the business you could keep your business in the family, sell to management or employees, be bought out by investors…

Why you should raise your prices

Running a business can be stressful, there's no question about that.

In the lead up to EOFY, we held tax planning sessions, new year goal discussions, and had a general catch up with most of our business owner clients. Apart from these…

How do I overcome my customers’ fear of spending?

One of the biggest complaints from salespeople in a tight economy is the time it takes to achieve a sale. So, what can you do to speed up the sales process?

Sell the solution not the product

Branding is wonderful but unless your brand…

How do I manage payroll effectively?

Payroll is one of those things that starts out simply enough. You start your business, hire a few employees, and things tick along pretty well. It’s straightforward enough to keep everything in line at first, but what happens to most companies…

EOFY Super deadline is approaching

We'd like to have your attention about superannuation payments prior to EOFY.

Although not necessary, you have the option of:

paying employee super one month early

topping up extra super into your own fund

Both will give you a…

What do I do before EOFY?

EOFY is once again around the corner, and we encourage business owners to be proactive. Talk to your accountant, look at your books, and make any little adjustments needed before June 30 hits. This will have optimal results for next financial…

Is my business idea a good one?

5 steps to test your business idea

When you’re in business for long enough, you’ll likely come up with new ideas you want to try. Innovation is important for your company to grow, to diversify its income, and to attract new customers.…

Secrets to keeping your employees happy

Traditionally, employers have relied on giving employees raises as a way to retain their staff and reward them for being hard-working and loyal. Raises can get expensive, and there is often an upper limit for what you can offer when it comes…

How do I set up my Director ID?

Since 5th April 2022, all directors must apply for a Director ID BEFORE being appointed a director.

It is free to apply for your director identification number, but you must apply for your own number and verify your identity. No one else…

Refining your Ecommerce pipeline

Businesses are increasingly moving online to expand their reach and provide the best possible experience to their customers. Being online, however, means more competition, so business owners must come up with ways to amp up their game to gain…

Director penalty notices for debts

The ATO have announced that they will be targeting unpaid debts very soon, with only 21 days to pay.

They will first be sending out letters stating that they might send out a penalty notice soon.

This will affect many thousands of…

How to get your construction business paid faster

Steady, reliable cash flow is crucial for the survival of your construction business – so taking steps to ensure your customers pay promptly is a key priority.

Nine tips to reduce debtor days for construction business owners

Debtor days…

Rent relief extended

What do we know?

The Victorian Government have announced that the business rent relief previously closing on 15th January 2022, will be extended further until 15th March 2022. This is great news for businesses struggling with omicron cases.

The…

What is my accountant talking about?

Sometimes accountants use words that most small business owners don't understand. We try our best not to do that, and explain things as simple as possible. Sometimes though, there are some important terms that need to be used.

Here we explain…

Business plan template

Happy New Year!

If you are excited about the new year and the possibilities that it brings, we have a gift for you.

A new year is a great time to sit back and reflect, and then improve your business.

Whether you are thinking about starting…

Succession planning: A will for your business

The unfortunate reality is most business owners don’t take proper holidays. Usually this is because their business relies on them and they don’t have the support to keep the business running without them.

As a business owner, have…

How much cash does my business need?

Your business needs cash. Cash is what keeps your company in operation and enables it to grow, so you should know how much cash your business needs to survive. Although many people think the answer is linked solely to operating expenses, this…

Business structuring webinar recording

Business structuring, while a dry topic, is important.

We recently held a webinar going through the ins and outs of the different business structures available in Australia, and the pros and cons for each.

Whether you are setting up a new…

How to get your business back on track after lockdown

As you well know, the COVID-19 pandemic is not just a public health issue, it’s also caused lockdowns and resulting financial worries on a global scale.

In Melbourne alone, we've had 6 lockdowns over 2 years, tipping us over 200 days in…

How to scale your business with minimal effort

If you want your business to grow, at some point you’ll have to think about scaling it. Scaling it isn’t exactly the same as growing it, though they are often used interchangeably. Growth refers to adding resources and increasing your revenue…

What is Director ID?

In its 2020 Budget Digital Business Plan, the Australian government announced the full implementation of the Modernising Business Registers (MBR) program. The program is designed to both establish the new Australian Business Registry Services…

What is a Stapled Super Fund?

There's a change to superannuation that means to comply with 'choice of fund' rules you might need to do something extra when a new employee starts to work for you.

Previously, if a new employee doesn't choose their own super…

Construction support

On the 2nd October the Victoria Government announced they would support construction businesses with cash grants for the 2 week closure of the construction industry.

Applications are now open.

If you are a managed business client of ours,…

Victorian business support for October

The Victorian Government has announced additional funding to help support businesses for the next 6 weeks up until a point where we should be at 80% double vaccination rate.In this article we have outlined the following:

1. Business…

3 ways to motivate workers

The question of motivating employees is often on a business owner’s mind. It can be difficult to find ways to genuinely motivate employees at work, and often the old standards—performance-based bonuses, increased rewards and commissions—only…

Freedoms for the fully vaccinated and what it means to business

Australia’s two largest states and the ACT are in lockdown as the Delta strain of COVID-19 takes its toll while others are standing firm on a policy of eradication. The result is a country at a policy impasse and divided by border restrictions.

And,…

Don’t wait for disaster to innovate

This blog article is over on the Xero blog, and it's quite good, so we thought we'd share it over here too.

It's written by a New Zealander, but as Covid-19 is affecting us all it is still relevant. As we don't know if we will be back in…

Cashflow advice for small businesses

Solid cashflow management is vital to ensuring your business survives, but not everyone understands what cashflow is or how to manage it. That’s likely what makes it a leading cause of stress for small business owners. In fact, a Capital One…

More support for Vic businesses

The Victorian government have announced some new supports to help businesses most affected by the current restrictions.We're going to specifically talk about these support measures:

The Covid-19 Disaster Payment

An additional $2,800…

Business Growth Checklist available

We have just created a new business download that is quite helpful.

Over at Optimised Accounting, we love checklist, and if you do too feel free to download this tool.

Once your business is up and running, it’s important not to rest…

3 reasons why business partners break up and how to prevent them

For many business owners, partnerships are an ideal way to run a business. Operating a business with a partner means you don’t have to make all the decisions on your own. It means you have someone there with you, to help you carry the burden…

Separating personal and business expenses

There are some things in life that go together well and others that definitely do not. Business and personal finances are in the category of items that should not be mixed. Although it may seem like a headache to keep them separate—who…

Managing field workers in your construction business

It’s one thing to manage workers when they’re all in the same place at the same time. However, when you run a construction business with field workers, things can get a lot more challenging. Not only are you typically not on the same job…

If my business is making a profit – where is the cash?

Some small business owners find themselves in the difficult position of running a business that appears to be profitable, but still having no money in the bank. It’s an important situation to address. After all, a lack of adequate cash…

3 consequences of avoiding your bookkeeping

If you ask 100 business owners what they like least about running a business, chances are good that bookkeeping will rank high on the list. It’s an annoying and frustrating chore that takes up a lot of time and is easy to put off until tomorrow.

Avoiding…

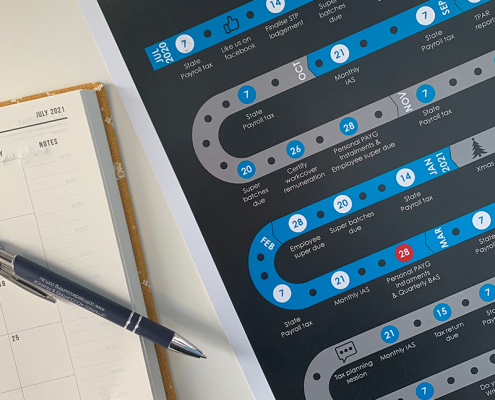

2021 Due dates

Business due dates available as download.

Updated posters available

The last 2 years Optimised Accounting created and distributed a poster for business owners to see at a glance the important due dates for businesses.

Now that all of…

The New Lifetime Director IDs

Directors will be required to register for a unique identification number that they will keep for life, much like a tax file number under a rewrite of Australia’s business registers.

ASIC does not currently verify the identity of directors…

Buying a business

Many of us dream of running our own business, with all the independence and satisfaction that offers. While striking out on your own can be personally and financially rewarding, getting off to a good start is crucial to success.

So if…

What is key person insurance?

What happens if a key employee or one of the part-owners in your business becomes critically ill or dies? It’s a question nobody likes to think about. In fact, only six per cent of Australian small businesses have insurance to safeguard their…

Weighing up the cost of risk – insuring your business

Running your own business can be rewarding, but there is also risk involved when you put your own money and reputation on the line. What would you do if your shop was destroyed by fire, a client sued over advice you gave, or your business was…

Preparing to sell your business

Business owners, I'm talking to you.

Whether you love your business or not, you may not plan on working in it forever. Be it you want to keep working for a long time, you are coming up to retirement age soon, or you simply want to have a…

COVID-19 Vaccinations and the Workplace

The first COVID-19 vaccination in Australia rolled out on 21 February 2021 preceded by a wave of protests. With the rollout, comes a thorny question for employers about individual rights, workplace health and safety, and vaccination enforcement.

The…

Tax updates: March 2021

Individuals and small business owners who have taken advantage of the government’s COVID-19 support programs will find themselves increasingly under the tax man’s microscope in coming months. This is just one of the key developments occurring…

What is a BAS anyway?

We mostly deal with businesses who already are in business and therefore aware of what a BAS is, but if you are new to business and GST, you may be scratching your head as to what a BAS is, why you have to lodge it, and how. So we've found…

Winding up: Simplifying small business insolvency

On 1 January 2021, new laws came into effect that introduce a new, simplified debt restructuring and liquidation framework for small business.

Drawing on key features of the Chapter 11 bankruptcy model in the United States, the new system…

How to sell your business

We’re often asked the best way to sell a business. There are two key components at play in the sale of a business; structuring the transaction and positioning the business to the market. Both elements are important and can significantly…

Get paid faster with these invoice tips

No one likes late payments from their customers. Late payments have a negative effect on cash flow. Chasing customers for payment takes valuable time. Prevention is better than cure when it comes to getting your invoices paid on time. Here…

Has COVID-19 devalued your business?

If you are selling your business, merging, acquiring, or inviting in new investors, you need to understand the value of your business.

But, to what degree does the pandemic impact on value?

Should you discount or hold firm to pre COVID-19…

Forecasting during a pandemic

Now, more than ever, business operators should have a plan in place to manage during uncertain times. Even if your business is not directly impacted, it’s likely your customers, your supply chain, and your workforce will be to some extent.

So,…